How to crowdfund your craft beer business

In June 2022, A Hoppy Place successfully completed an equity crowdfunder using the Seedrs platform and raised £149,000 in exchange for circa 12% of our business. This money was directly used to pay for the costs of opening our second outlet in Maidenhead.

But Crowdfunding is not an easy, or simple process – and it’s also one that’s politically challenging to navigate successfully. After all, why should the public help a business expand? What’s in it for them? Why can’t that company get that money of their own accord?

Having made a very conscious decision to run an Equity crowdfunder (more on the differences between equity and non-equity rounds below) to fund our second premises, I thought I’d give you some context on the why, wherefore, and whether I’d do it again.

But first – a tiny bit of background on our business, and the reason we chose to expand from our first home in Windsor…

A post-pandemic Hoppy Place

About a year ago – I dusted off the cobwebs on my blog and penned ‘Inbetweenland‘ – a look at the industry post-pandemic, and focused on the way we as an industry were perhaps generating a self-fulfilling zero-sum game with breweries cutting out the supply-chain and marketing smallpack sales direct to the consumer.

A lot of what I wrote then, I stand by. Primary within that – the fact that Smallpack isn’t the market it was, and potentially won’t be again.

But I have still been surprised by just how many people, even if they’re ordering and drinking less at home: At least for us – do want to go out and have a pint.

For bottleshops up and down the country, they were now losing out to two simultaneous markets. On the one hand, those breweries are still doing all they can to get direct to consumer sales – and on the other – people are drinking less at home, favouring the taproom or pub experience.

Our Windsor bar won pub of the year during lockdown, and SIBA’s craft beer retailer of the year not much later. We did this by hosting online beer events and distributing product to people’s door. But our Windsor bar also has a 30 person capacity, and is probably about 5 minutes too far away from the castle to ever really prosper as a drink in establishment, no matter how good the beer.

With takeout sales lower than they used to be, it was becoming obvious that Windsor wouldn’t continue to grow in this market. It’s a bar that breaks even, and that’s wonderful. But putting hundreds of hours a month into my hobby, in order to pay my wife and brother-in-law, but not myself, isn’t sustainable forever. For us: This was the classic case of expand or die.

We love our Windsor bar, and continue to invest in it. It’s our first home and a great many of our friends we met there. But. We knew in order to survive we needed a more central, events and drink-in focused space, so the British public can do what it most enjoys: Drink pints with their mates.

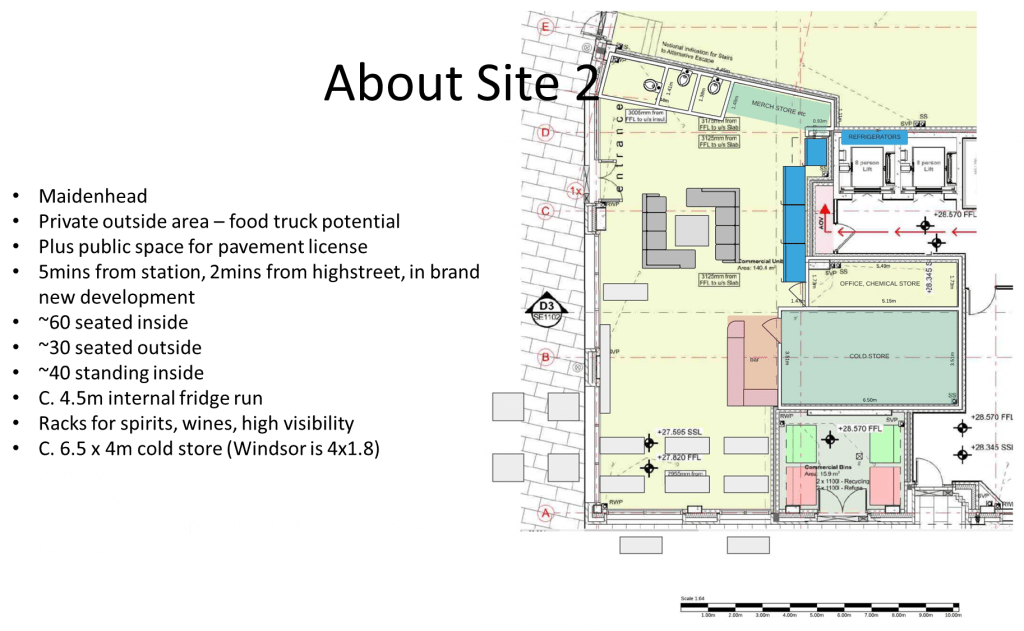

Fortunately, we’d already been planning A Hoppy Place 2.0: Maidenhead.

Why Crowdfund?

Free money! Am I right?!?

Definitely not.

Crowdfunding is hard work. Whatever type you do. But before I delve into how we ran our round, it’s important to distinguish between equity and non-equity crowdfunders.

“At the heart of the profound difference between equity crowdfunding and non-equity crowdfunding is the disparity between investing and making a donation in exchange for a promised reward..”

– Jason Vissers

The vast majority of craft beer crowdfunders have been the latter. The promise of a thing, usually a bar tab or some merch, in exchange for some of your hard earned. Give me £20 now and I’ll give you £30 later. That sort of thing.

These CAN work, but with a few key caveats:

- You will certainly earn less income overall in the short term (but compare this with the loss of equity of your business impacting future sale value of your business)

- You will very likely have less engagement in your project

- People may not appreciate your vision, and certainly they may invest less time in understanding your business

- It is likely to cost you more in the medium term as the expected rate of return is high. I regularly see offers of 50% or even 100% extra bar tab

And for me, the most important one of all:

- The “why can’t they pay for it themselves” / “why do they need my money” conundrum.

I think there is an issue of credibility when it comes to some crowdfunders, and especially non-equity crowdfunders. A great many of us have been sold a dream, some snake oil, or invest in a brewery only to see it fail months later. My great friends at Weird Beard for example raised a very respectable £46k only 6 or so months before their brewery in Hanwell was closed.

A question is always going to be “why do they need MY money – don’t they have it / can’t they get it?”

Both answers to that can be galling. Either the owner has access to his own funds and doesn’t want to invest them, or worse for the health of your investment: Doesn’t, and the banks are saying no.

That’s not to say there aren’t hundreds of incredibly successful non-equity crowdfunders! Of course there are. But that wasn’t the kind of round I wanted to run.

But for a non-eq crowdfunder, the firm is not putting their own skin in the game. Equity rounds? They very much are. That sharpens the mind, and I feel implies sincerity. At the very least – you can certainly no longer say the business is looking for “free money” – not that I think that’s often a fair criticism of course.

In any event, yes – we did an equity round. The rest of this article will talk through the what, why, and how we did it – and if we’d do it again.

How to run an equity crowdfunder

We gave away 12% of our company. This means 12% of Naomi and I’s nest egg if Hoppy is ever successful enough to attract a serious bidder and of course, we decide we no longer want to own this business…

To get there was a long process. We had a lot of decisions to make…

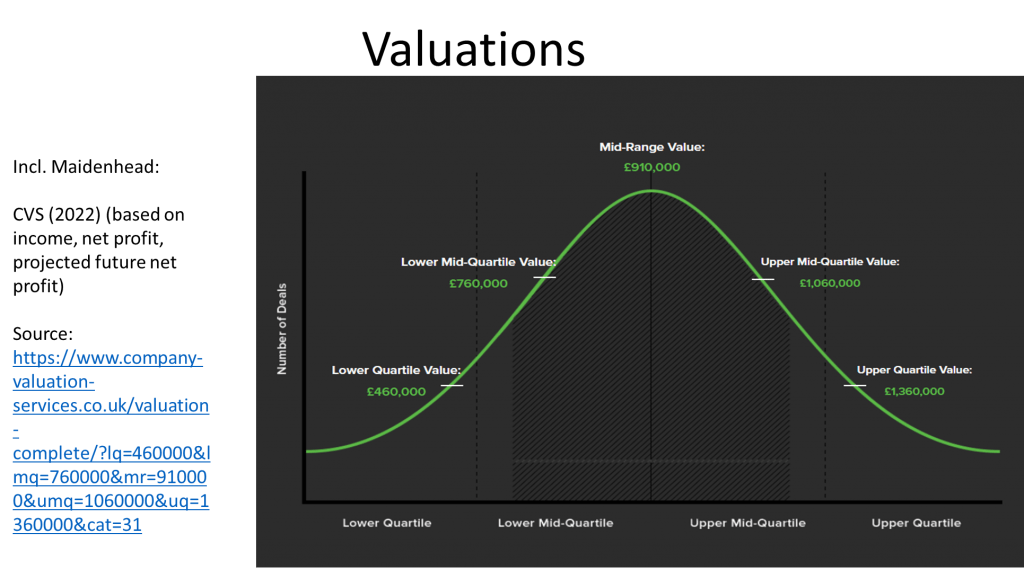

- How to value our company

- How much we were prepared to give away

- How to sell our valuation to prospective investors

- How to generate and convert additional investors

- When we needed the money by and what to do in the mean time

But before any of that, we needed engagement, and we needed a Platform.

Engage your community

First things first – you need an audience. We used the Seedrs platform for our raise. To launch on their platform, you need to evidence that you have at least 50% of your target raise secured already.

If you don’t have this level of engaged supporters already locked in – they’ll not take you on. That’s telling. Looking back at non-equity crowdfunders I think the too-commonly-held mantra of ‘if you build it they will come’ is assumed by many business owners. That isn’t the case. If you build it, a few will come. But many more will look at it – wonder what it is – but continue to do what they’re comfortable doing.

So you need to have people that are already comfortable and confident with you. Or you need to market exhaustively.

Seed funding a startup is another game entirely. I don’t have the marketing nouse to talk you through that – I’ve never done it. But if you’re launching a new product, a new brewery, expanding or whatever else – you need that customer base when you start.

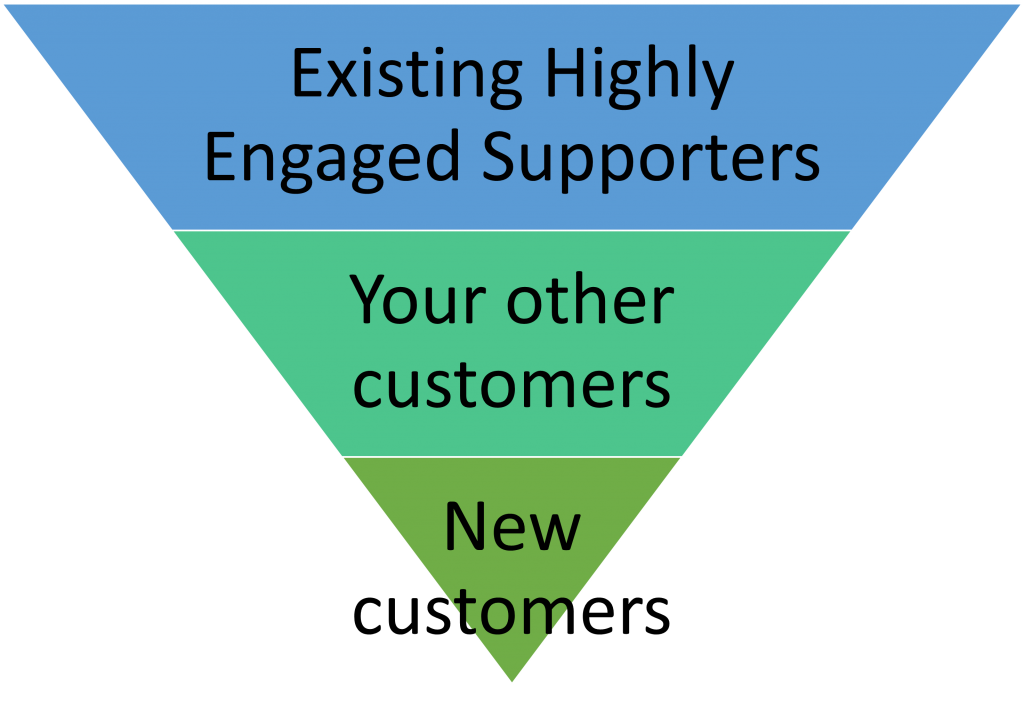

I guarantee, in terms of the levels of income you raise – your conversion chart will look something like this:

In terms of the initial 100% raise, roughly here’s what we found…

Without people prepared to listen – you won’t succeed

Hoppy had the benefit in June 2021 when I first presented to a selected audience of our lockdown assets. We’d built a mailing list of 1200 active customers, who mostly listened to what I had to say. They trusted me enough to hear me out with suspended cynicism. But that was the first hurdle only. Then I had to convince them to part with their money.

The presentation

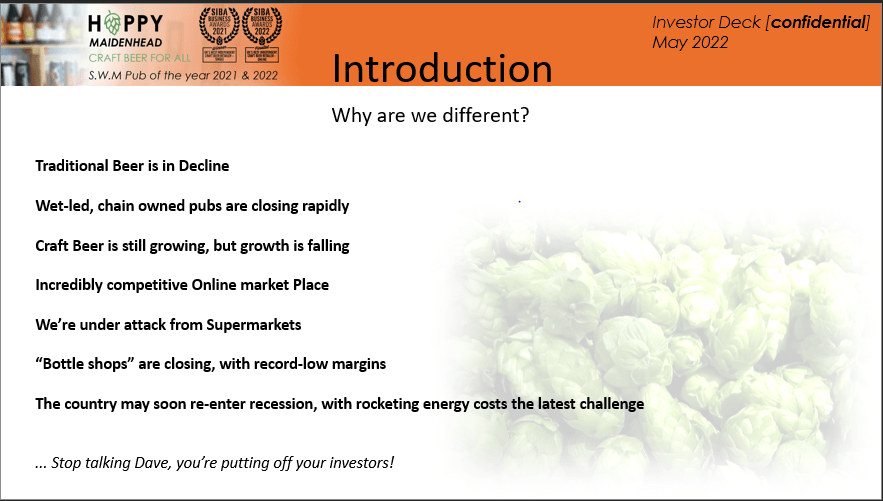

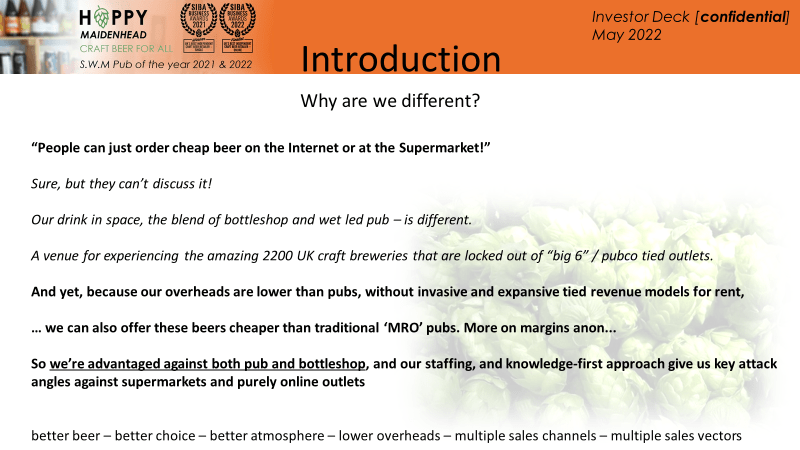

From June to late July 2021, I sat down with 30 or so customers that I’d seen to be big spenders or our most loyal customers. Most I knew could invest. Some I just wanted to feel engaged in our business. And what was the first thing I told them all?

I told them my business sector was basically fucked.

This is where you insert the sound clip of a vinyl record being stopped. That scratching bzzzzip! sound that tells you to hold your horses. But this is exactly how I started every presentation that led on to me trying to convince people to join our business, some times in exchange for £10k or more

Why?

Credibility, credibility, credibility.

We needed to show that we knew our market, what it wasn’t, and what the market we needed to chase needed to be. People need to know you’re not a snake-oil salesman. You’re not desperate. That you see the risks, but understand the opportunities – that their money is in… if not safe hands – investment is always high risk – then in hands cognizant of their operating environment and connected to eyes very open to the challenges ahead.

Our presentation then ran through many other essentials…

- Who our Directors are, where they came from

- Why we’re in this sector

- Our original business plan

- How we’ve navigated the market – in this case showing growth through covid by pivoting to online, but events focused. Build the community. Our business never stopped at the doorstep.

- Forecast revenues and profits for our existing business

- Mutliple scenario plans for our expansion

- Cash flow and profit and loss projections over the medium and long term

- And thus, the inputs for an array of company valuations…

Also taken into account of our valuation were the key intangibles: The strength of the management team. Naomi and I truly believe we understand our industry, of course. We’d not do this otherwise. But transmitting that is important. Be prepared to answer left-field questions, to justify yourself constantly, to name drop if you can. To show your past successes if you have them. How you’ve mapped into your business plan from the outset, and where you haven’t – why not.

What we had to get to – was our existing audience believing we were worth our company valuation. Because this formed 60% of our raise. And let everyone curious know that a great many people seemed to believe in us, our mission, and indeed that valuation. Because we knew and had shown the audience exactly what we needed, but want to keep as much of our company as possible.

This valuation I’d set at 1.2 million.

Close it out – Sell the dream…

Once you’ve got the hook, you can reel it in. I’ve never fished in my life so I won’t strain the analogy further. I’ll go with another. Sell the dream. People are curious, or excited, or cynical. You can use them all. Show them what they’re buying into

Our pitch deck and my presentations covered all of the above and more, took an hour to talk through – and led to a lot more 121 follow ups. I was asking people to commit a lot of their savings in some cases. You have to be prepared to put this time in, and be confident in your message. That’s how we got the first 60% of our funding.

The next 20% or so was super interesting. These were perhaps the less vocal regulars, but those faces I knew well for the most part. But a couple were truly outsiders to my business. People I knew from old endeavours or hobbies, friends of friends, people we’d never have dreamed would invest, and invest big.

I think that occured through organic reach. Word of mouth. Make your potential investors evangelists – and then make them your salespeople. That’s how you complete the funnel – but now we’re trading and I’m looking back in retrospect it’s also my favourite single reason to offer equity for the business I have today: We have 150 investors. I have 150 more salespeople telling their friends and family to come to A Hoppy Place. You cannot put a price on this engagement.

Which is lucky – because Crowdfunding isn’t cheap

Let me be very clear. Crowdfunding via a partner firm such as Crowdcube or Seedrs is not cheap. Going to a bank would be dramatically better value. And if you can’t get a business loan from a bank – look into Funding Circle.

I cleared a £60k loan at 9.9% APR from Funding circle once our crowdfunder had completed. The crowdfunder cost me nearly £14k for a 149k raise. Nearly identical costs.

Seedrs take their cut. Accountants take a cut. It is what it is. To reiterate though, what have I also bought whilst giving away some of my company? Why on earth would I trade one cost for another and also lower my potential long-term return? It’s that engagement.

A crowdfunder is for you if you’re certain you can extract absolute value from your investors. Yes a strong valuation and a good return for as small an amount of your company as possible: But also because they are now invested in your success. If you cannot be confident you can leverage your investors strengths (in terms of hype, but also – a lot of them probably know business, know tax, know a good accountant, and have genuinely good ideas to develop your brand … ) – don’t do it. Borrow.

A simple summary of all this would be: If you don’t think you can convince your mates and best customers to step in for the majority of the opening round: Don’t do it. Borrow. If you don’t think those people are good people to spend time talking business with: Don’t do it. Borrow.

You also need to understand legislation, taxation, and the need for citation!

Before you start this process, you’ll want EIS. The Enterprise Investment Scheme allows individuals and partnerships to get up to 30% off their own personal tax liability when they complete their tax return. This is a huge perk for many of your investors.

The reality is, they could get a 5k investment for £3,500. That’s £1500 of free shares in your company.

The process isn’t straightforward, but I did get EIS advanced assurance myself. If you’ve set up a company (rather than use a provisioning service) then you can do this. If not, plenty of accountants are around to help you – such as mine. Delia at Two Rivers accounting, who as the ex-director of award winning brewery Binghams (Champion Beer of Britain for Vanilla Stout, in 2016) knows a thing or two about beer businesses. She’s also an investor in Hoppy. Pay it forward, pay it back.

Postround, you’ll get very familiar with companies house resolutions, SH01 and SH02 forms, and lots of other procedural documentation to let HMRC and our government know that your company looks the way you think it looks in their eyes.

Make those evangelists your regulars

This point might not be analagous to all sectors. But I’ve spoken about equity versus non-equity crowdfunders a lot so far. It’s only right that I point out, I actually employed a hybrid, which has worked very well for us.

We gave away the equity, we got in our income. But we also offered investor perks! Why? Conversion. I want every one of my 150 investors to be bar regulars. Their startup capital is just a part of it. Our Windsor outlet often only has 6 or 10 people drinking inside. If I can get 20 or 30 of my investors in there once a week, and another 100 or so into Maidenhead: I’ve got a community that’ll pay the bills before I even start attracting new locals.

It’s hard to quantify the impact of these rewards, they’re very generous. But there’s a lot to be said for having a vibrant, full bar full of our most loyal customers as often as possible. It’s fantastic for atmosphere and community building.

In the hospitality sector I strongly recommend considering it.

To Divvy or not to Divvy, and the ‘exit strategy’

One big gotcha: If you intend to pay yourself dividends in lieu of salary, get this set up before you start with Seedrs. It might make sense to claim a bonus, not a salary for reasons beyond the scope of this post. If you try and do that without catching this, your shareholders will all want a slice too.

And it brings me on to a bigger point – they will want a slice!

A Hoppy Place targets future expansion. So much so, I’ve not yet paid myself a penny. Although I have 6 full time employees now, money retained is money towards site 3, site 4. However big we go. Investors were told this at the absolute outset. If they were coming in because they wanted a salary top up out of my company’s coffers, I was clear. That won’t be the case. What we have we hold, and later invest.

We lost a couple of investors, but most understood it. Many were happy to hear what our long term strategy was.

Their exit strategy, should they ask – is simple. They’re investing in us because they believe we will keep increasing our valuation. That we’ll keep growing. If they ever want to sell in future – they’ll hopefully get more back than they put in. Naturally this isn’t anything I can promise, in fact legally I must always tell all of our investors that their capital is at risk, but it was clear.

I get dividends. They don’t. I put a statement in writing about how I planned to use personal dividends – it went something like “To pay the directors in line with a market race salary for the role as agreed by the board”.

Just make sure your company is set up the way you need it to be if exploring this before you start with Seedrs or any other platform.

Talking of legislation,

The last real headache comes with this simple term: More evidence needed.

Please provide evidence that some pubs need new carpets

We’re very nearly reaching the end of my guide, but I cannot overstate this enough:

Be prepared to have absolutely everything you say questioned.

I made the mistake of quoting myself in my pitch deck – referring to the Inbetweenland article that started today’s post. I was told I was not a reliable source of evidence about my own bar. We got there in the end. But ‘them lawyers’ don’t mess about.

I was very genuinely told to provide evidence that ‘many pubs need new carpets’. I probably spent 30 or 40 hours generating evidence to back up my pitch. Every email I sent out was held until fact-checked. I understand the need, just – prepare for it.

But it was worth it – and done right – you can achieve similar success

In the end we got through the regulations, EIS assurance, the pitch evenings, the updates, and the funding of our build. We got open. We have 150 new investors, big evangelists telling friend family and anyone in earshot about their beer shop and taproom. And we have achieved a fantastic first 10 weeks of trading in Maidenhead: Far above the forecasts I put to our potential investors.

I hope my story answers a few of the questions on how, and why, you might run an equity round.

I took inspiration from a number of successful campaigns in the sector, as well as learning what to avoid from several others. You could do well to look at the following successful rounds for more inspiration:

- A Hoppy Place – Seedrs – That’s us!

- Siren – Crowdcube – Siren raise over 150% of their target for new canning line. Daron’s presentations really gave me a framework to run my campaign by

- Hammerton – Crowdcube – Hammerton hit the target required to open their dedicated taproom space in North London

- Mad Squirrel – Crowdcube – Mad Squirrel raise £300k to develop their brewery and expand into up to 5 new sites

And lastly, would we do another round?

I firmly believe in the benefits of an equity crowdfunder done well. But we gave away 12% of our company to achieve this. So for two reasons – no, I don’t plan to run another round.

Firstly – our friends at “The Scottish Brewery” have shown us the erosion of loyalty you can cause by diluting the shares of existing members. If I sell more company shares in future – I’m hurting those initial loyal investors. It’s a very careful line to walk and though I see some local businesses and breweries that have run multiple crowdfunders, it is a dangerous path.

Secondly – one thing we did make clear as owners was that we wanted silent partners. I see lots of community pubs and sitting as I do also on CAMRA committees and the like I can say confidently – death by committee is a very real problem. I know how to run a beer business. Some of my investors may, but many won’t. And moreover, I may not have time to wait for them. I cannot have a vote on every minor decision.

Naomi and I having over 75% of our company between us means passing special resolutions – making fundamental changes to our company – can be done without having to ‘sway the masses’. We know how to run our bars, and will continue to do so. After all – that’s why people invested in us in the first place…

So think carefully on repeated crowdfunder rounds. Equity crowdfunders carry all the benefits I’ve prescribed and many more besides, but dilution can generate a law of diminishing returns for engagement as well as your own potential future sale value!

Your turn?

Whether you’re a beer business owner, or were just intrigued in our process, I hope my blog has given you some context and clues on how these things work.

Successful rounds depend on a clear management plan, a great salespitch, and a deep understanding of the impact of a round of funding on your business, and your prospective investees. It’s not easy and you need to do a huge amount of leg work, nearly a year in our case, before you go to market. But if you do it well it’s a fantastic tool for engagement and evangelism in your business.

And I might run a non-equity crowdfunder in future, just not an equity one. Many of the lessons are the same. Clarity and credibility are absolutely sacrosanct.

If anyone reading ever wants to bounce ideas off me, you know where I am. If you’ve come even close to reading this whole post, you’ll know I can talk.

So see you at A Hoppy Place near you soon for a beer and a chat.

Cheers!

0 Comments